Crux of Indian Economy book is available in our App

https://play.google.com/store/apps/details?id=co.haward.psifc

Q.1

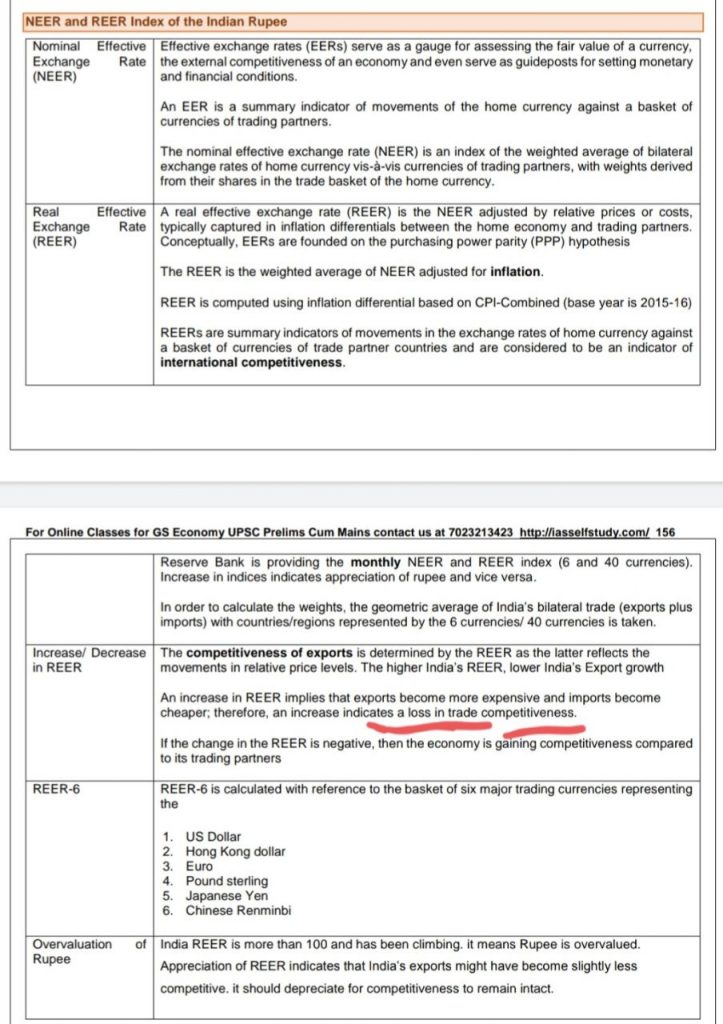

With reference to the Indian economy, consider the following statements:

- An increase in Nominal Effective Exchange Rate (NEER) indicates the appreciation of rupee.

- An increase in the Real Effective Exchange Rate (REER) indicates an improvement in trade competitiveness.

- An increasing trend in domestic inflation relative to inflation in other countries is likely to cause an increasing divergence between NEER and REER.

Which of the above statements are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans c (Refer Page no 156 of Crux)

Q.2

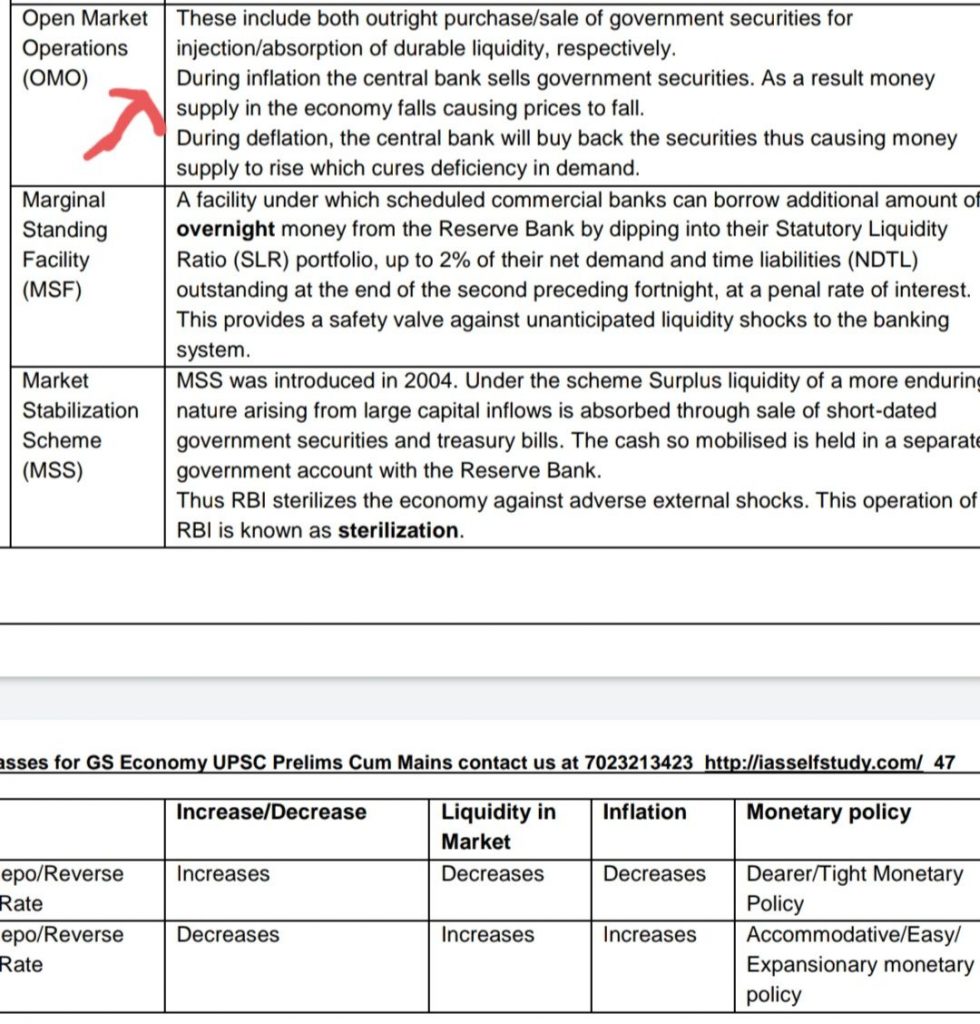

With reference to the Indian economy, consider the following statements:

- If the inflation is too high, Reserve Bank of India (RBI) is likely to buy government securities.

- If the rupee is rapidly depreciating, RBI is likely to sell dollars in the market.

- If interest rates in the USA or European Union were to fall, that is likely to induce RBI to buy dollars.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans b (Refer Page no 46 of Crux)

Q.3

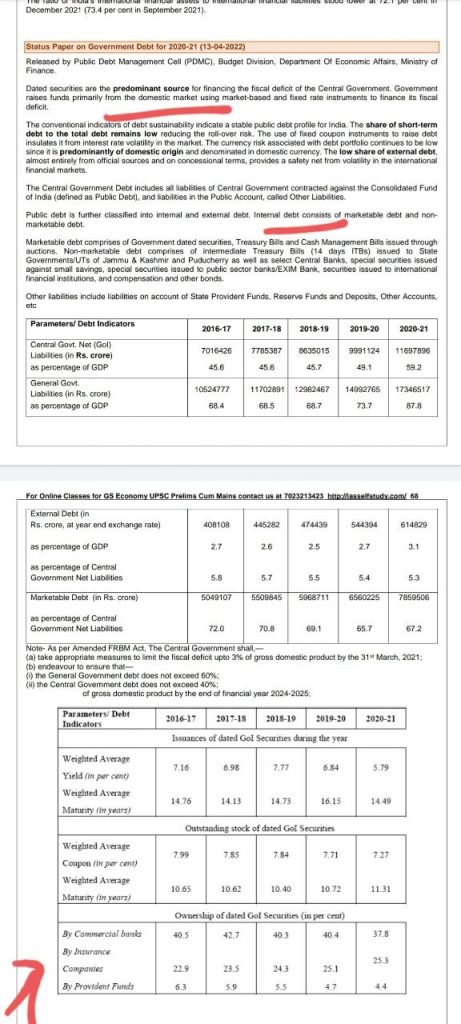

With reference to the Indian economy, consider the following statements:

- A share of the household financial savings goes towards government borrowings.

- Dated securities issued at market-related rates in auctions form a large component of internal debt.

Which of the above statements is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans c (Refer Page no 67 and 68 of Crux)

Q.4

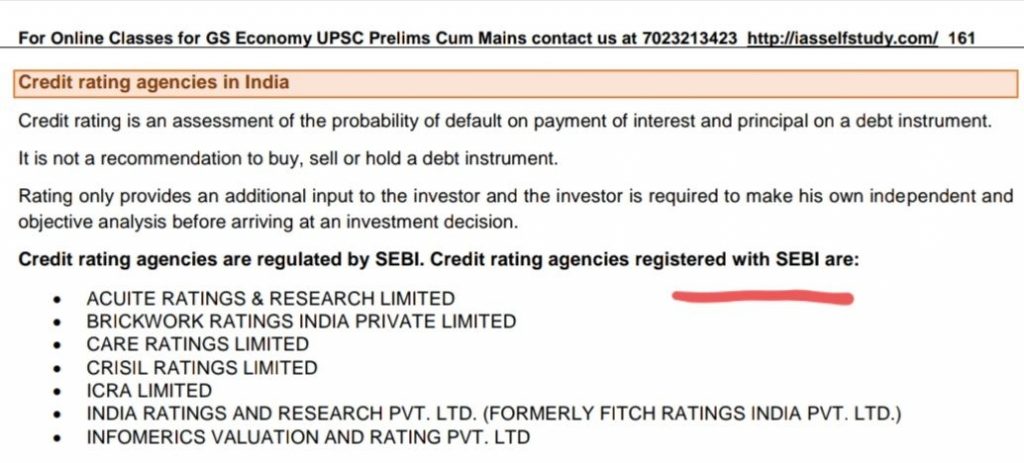

Consider the following statements :

- In India, credit rating agencies are regulated by Reserve Bank of India.

- The rating agency popularly known as ICRA is a public limited company.

- Brickwork Ratings is an Indian credit rating agency.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans b (Refer Page no 161 of Crux)

Q.5

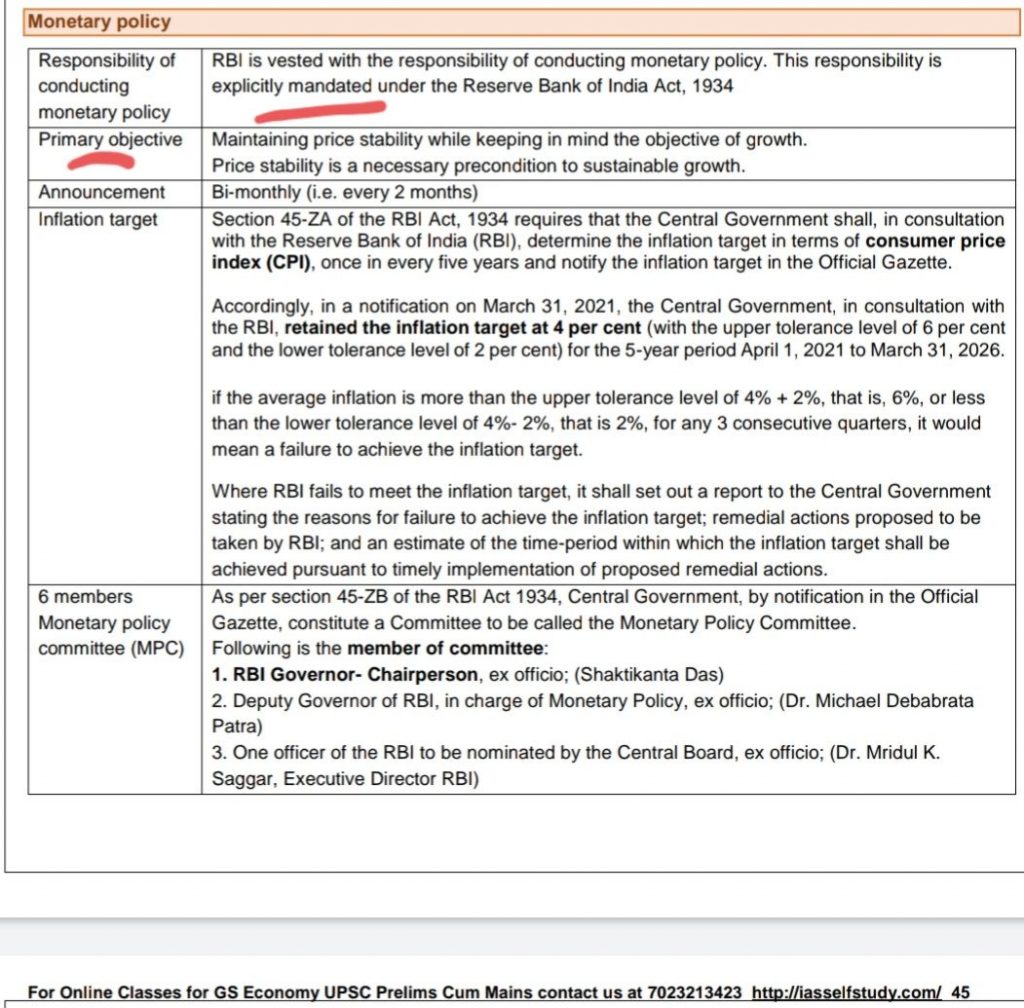

In India, which one of the following is responsible for maintaining price stability by controlling inflation ?

(a) Department of Consumer Affairs

(b) Expenditure Management Commission

(c) Financial Stability and Development Council

(d) Reserve Bank of India

Ans d (Refer Page no 44 of Crux)

Q.6

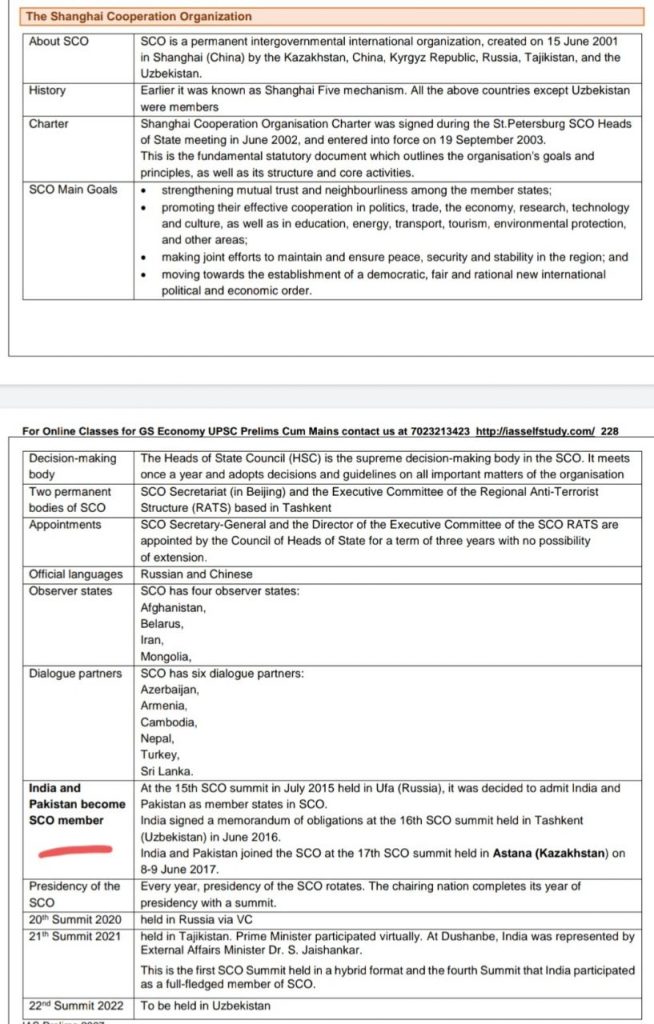

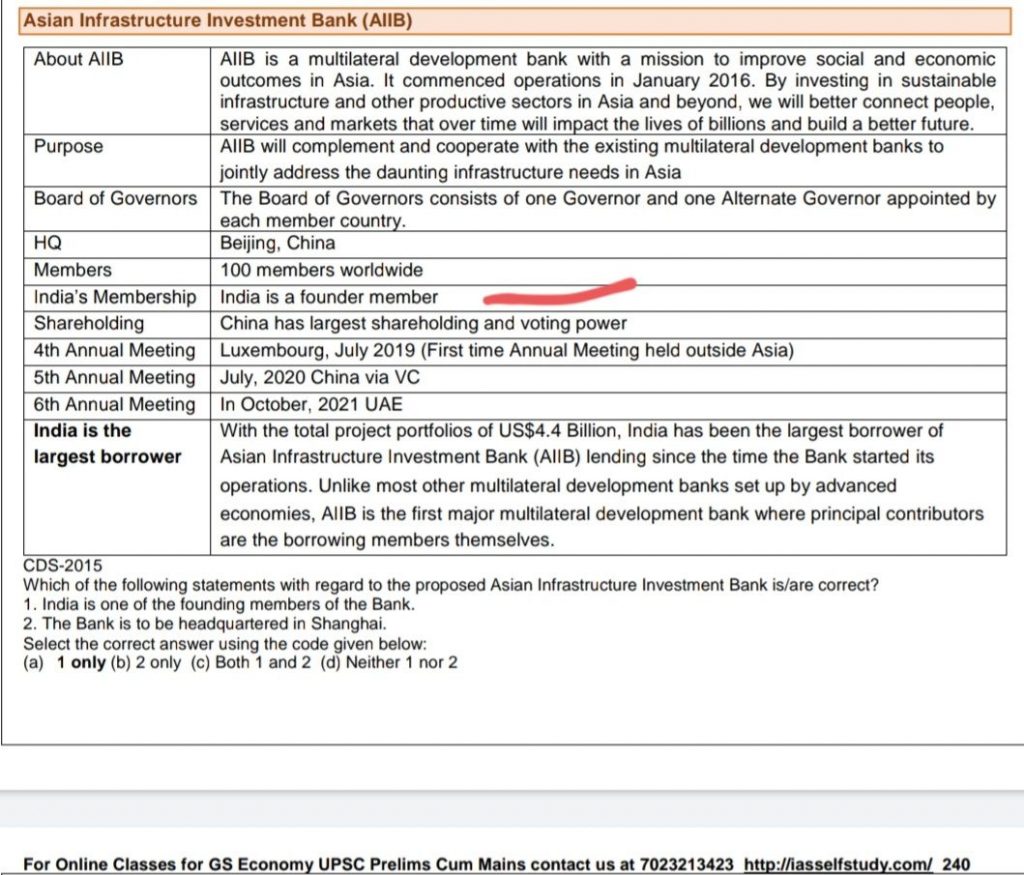

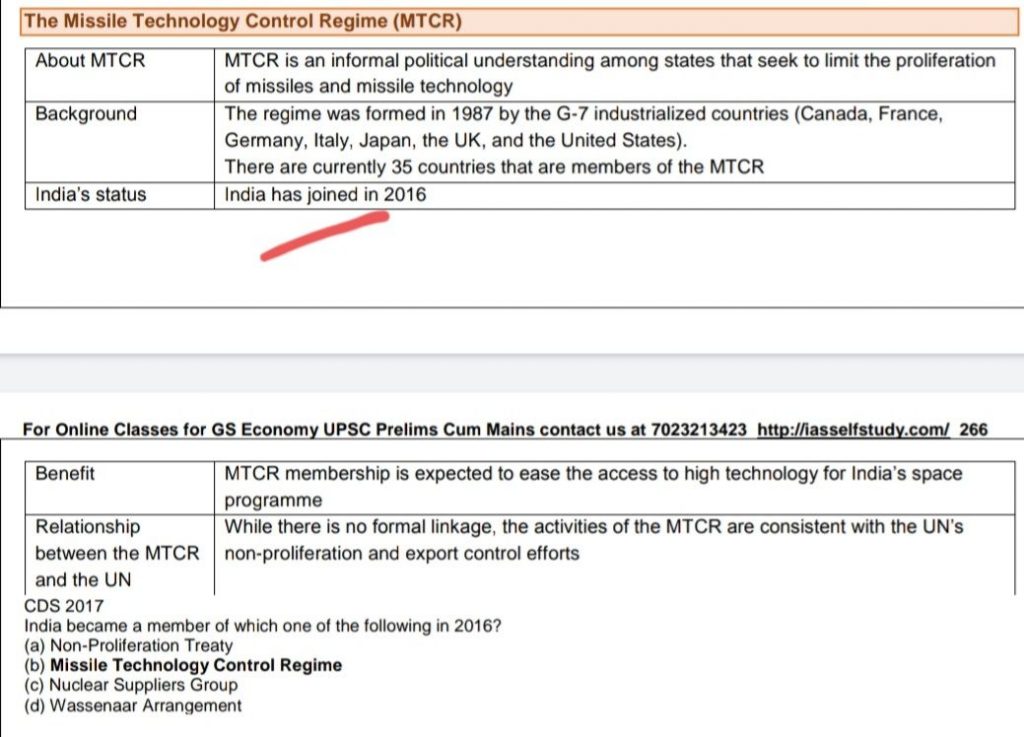

Consider the following:

- Asian Infrastructure Investment Bank

- Missile Technology Control Regime

- Shanghai Cooperation Organisation

India is a member of which of the above ?

(a) 1 and 2 only

(b) 3 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans d (Refer Page no 228, 239 and 265 of Crux)

Q.7

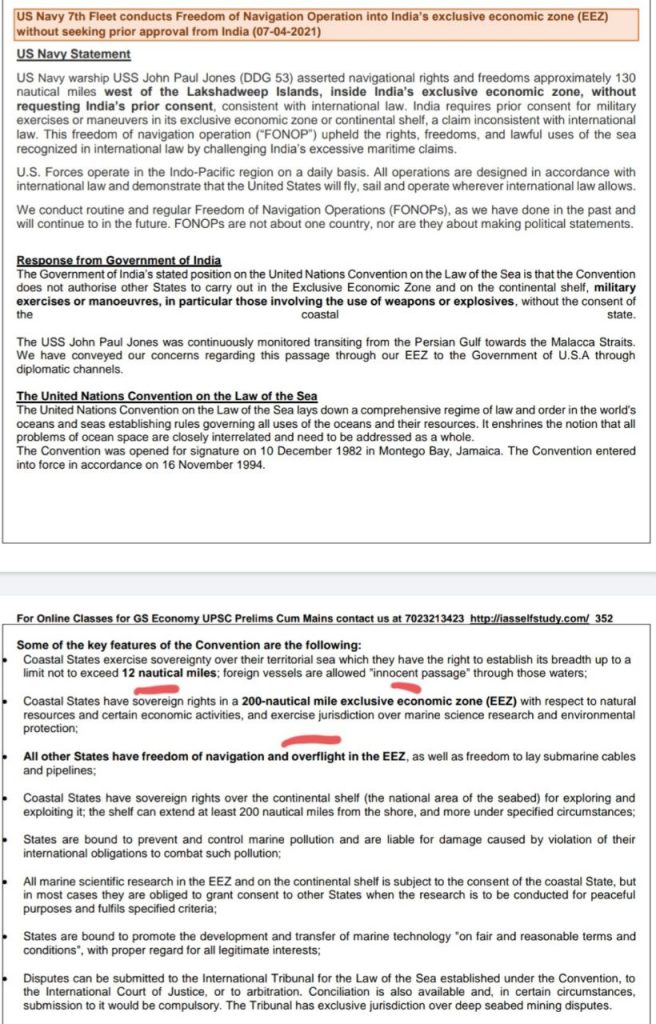

With reference to the United Nations Convention on the Law of Sea, consider the following statements:

- A coastal state has the right to establish the breadth of its territorial sea up to a limit not exceeding 12 nautical miles, measured from baseline determined in accordance with the convention.

- Ships of all states, whether coastal or land-locked, enjoy the right of innocent passage through the territorial sea.

- The Exclusive Economic Zone shall not extend beyond 200 nautical miles from the baseline from which the breadth of the territorial sea in measure.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans d (Refer Page no 351 of Crux)

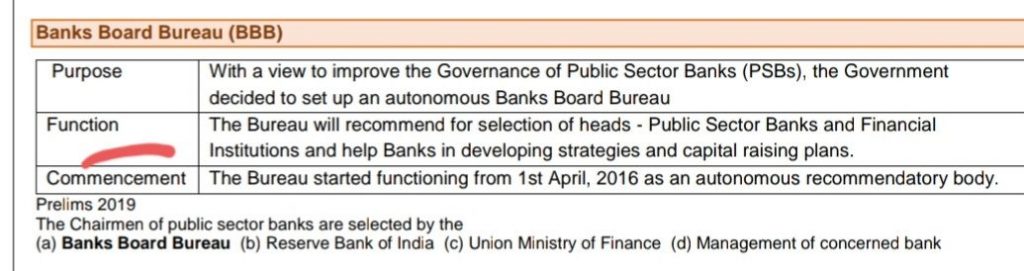

Q.8

With reference to the ‘Banks Board Bureau (BBB), which of the following statements are correct ?

- The Governor of RBI is the Chairman of BBB.

- BBB recommends for the selection of heads for Public Sector Banks.

- BBB helps the Public Sector Banks in developing strategies and capital raising plans.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans b (Refer Page no 93 of Crux)

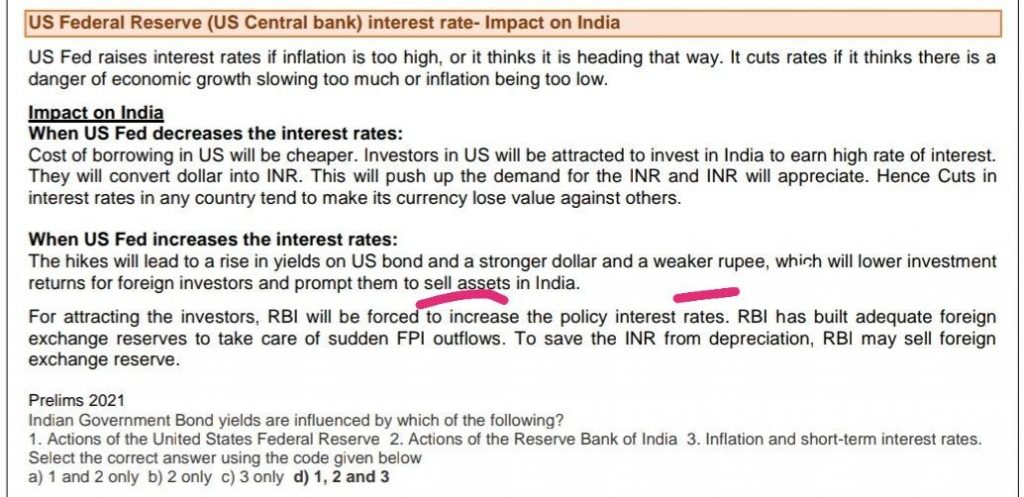

Q.9

Consider the following statements :

- Tight monetary policy of US Federal Reserve could lead to capital flight.

- Capital flight may increase the interest cost of firms with existing External Commercial Borrowings (ECBs).

- Devaluation of domestic currency decreases the currency risk associated with ECBs.

Which of the statements given above are correct ?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans a (Refer Page no 40 of Crux)

Q.10

With reference to Non-Fungible Tokens (NFTs), consider the following statements :

- They enable the digital representation of physical assets.

- They are unique cryptographic tokens that exist on a blockchain.

- They can be traded or exchanged at equivalency and therefore can be used as a medium of commercial transactions.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only 1

(d) 1, 2 and 3

Ans a (Refer our Budget 2022 video time 26:00)

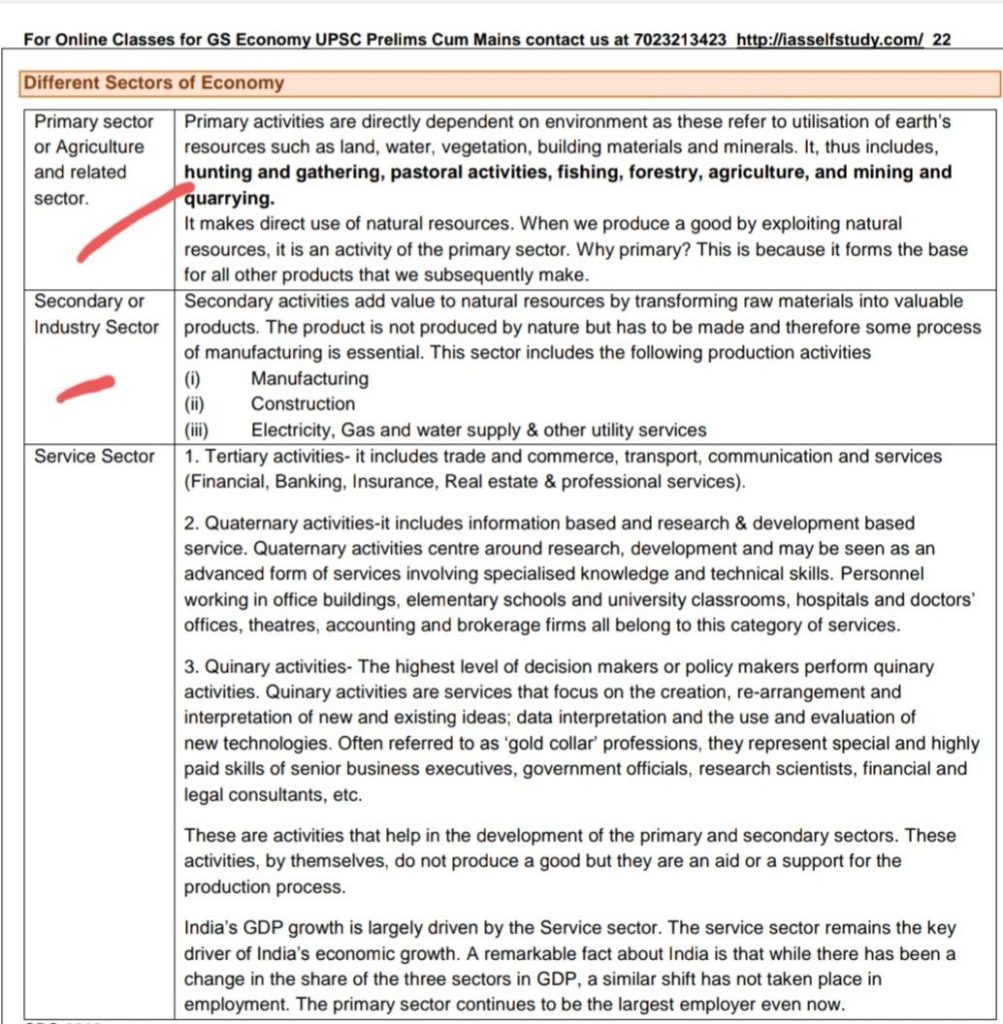

Q.11

Which of the following activities constitute real sector in the economy?

- Farmers harvesting their crops

- Textile mills converting raw cotton into fabrics

- A commercial bank lending money to a trading company

- A corporate body issuing Rupee Denominated Bonds overseas

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2, 3 and 4 only

(c) 1, 3 and 4 only

(d) 1, 2, 3 and 4

Ans a (Refer Page no 22 and 24 of Crux)

Q.12

With reference to the India economy, what are the advantages of “Inflation-Indexed Bonds (IIBs)”?

- Government can reduce the coupon rates on its borrowing by way of IIBs.

- IIGs provide protection to the investors from uncertainty regarding inflation.

- The interest received as well as capital gains on IIBs are not taxable.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans a (Refer Page no 58 of Crux)

Q.13

With reference to the expenditure made by an organization or a company, which of the following statements is/are correct?

- Acquiring new technology is capital expenditure.

- Debt financing is considered capital expenditure, while equity financing is considered revenue expenditure.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans a (Refer Page no 142 and 354 of Crux)

Q.14

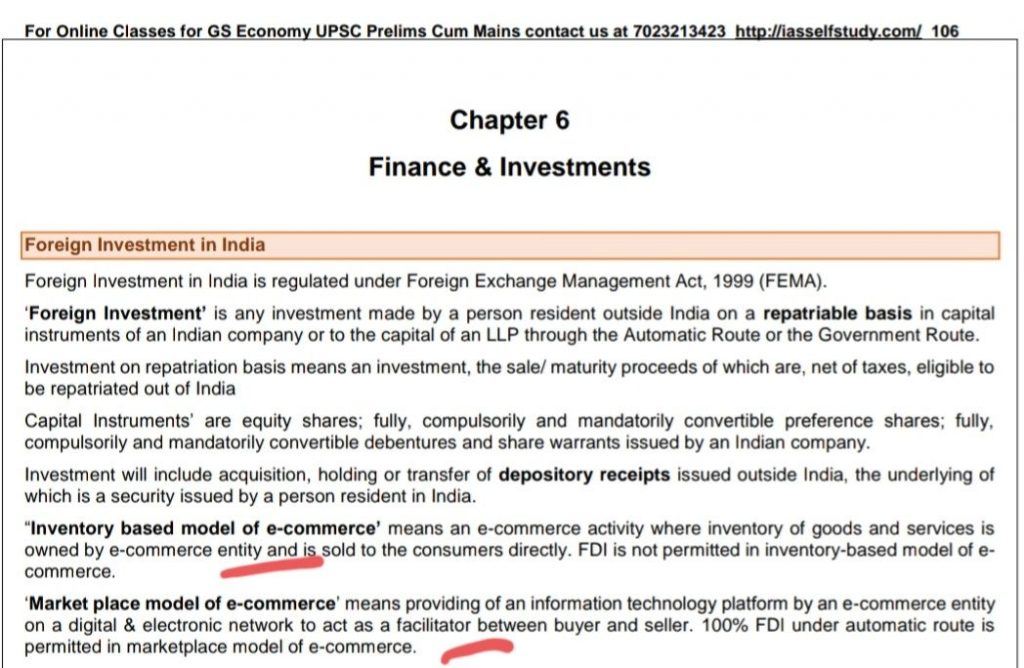

With reference to foreign-owned e-commerce firms operating in India, which of the following statements is/are correct?

- They can sell their own goods in addition to offering their platforms as market-places.

- The degree to which they can own big sellers on their platforms is limited.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans b (Refer Page no 106 of Crux)

Crux of Indian Economy book is available in our App

https://play.google.com/store/apps/details?id=co.haward.psifc

Students review of Crux Book after Prelims 2022 Exam

https://youtube.com/shorts/7VR8NL1a1gw